GRANT, TAX EXEMPTION AND/OR LEASING, WITH AMOUNTS REACHING UP TO 75% OF THE PROJECT BUDGET

The amendment of Development Law 4887/2022, entitled “Sustainable development, productive transformation of the Greek economy – Amendment of provisions of Development Law 4887/2022”, has been approved by the Hellenic Parliament.

The purpose of the Development Law is to promote sustainable development at national level, which includes the reduction of social and regional inequalities, as well as the strengthening of interventions to address the country’s acute demographic challenge. These objectives are combined with the productive transformation of the Greek economy, the design and implementation of a new productive model for Greece, with an enhanced role for industry and manufacturing, and the attraction of larger investments with a strong multiplier effect on the country’s economic life. In addition, the law aims to promote the adoption of new technologies that contribute to the extroversion and competitiveness of Greek enterprises and the domestic economy.

KEY DIFFERENTIATIONS

The most significant differentiation introduced by the new Development Law concerns the expansion of the range of enterprises eligible for grants. In addition to small enterprises, medium-sized enterprises are now also eligible for grants, thereby strengthening their access to development incentives.

Among the key changes is the increase of the maximum aid ceiling, which is now set at €20 million for individual enterprises and €50 million for groups of cooperating or affiliated enterprises. These limits may be increased by 50% when the aid is granted in the form of a tax exemption.

Furthermore, a special fast-track licensing incentive is introduced, applicable to large-scale investments as well as to investments implemented in areas with increased support needs.

Another important change is the possibility for each investor to submit an application for the same investment project under more than one aid scheme. It is noted that, once the investment project is finally approved under one scheme, all other applications submitted for the same project are automatically rejected.

Finally, the competent authority for the submission of applications will no longer be determined based on the size of the investment project, as was previously the case, but will instead be specified in each respective call for proposals.

AID INTENSITIES

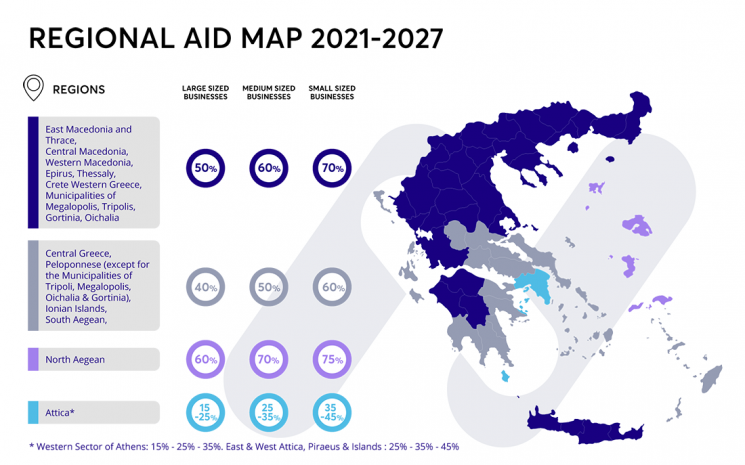

Aid intensity refers to the maximum amount of state aid that may be granted per beneficiary, expressed as a percentage of eligible investment costs.

The detailed aid intensity rates of the Regional Aid Map (RAM) are presented for each Regional Unit in the following map:

BENEFICIARIES

-

Commercial companies

-

Cooperatives

-

Social Cooperative Enterprises (Koin.S.Ep.), Agricultural Cooperatives (A.S.), Producer Groups (O.P.), Agricultural Partnerships (AES)

-

Consortia, provided they are registered in the General Commercial Registry (GEMI)

-

Public and municipal enterprises and their subsidiaries, subject to specific conditions

-

Sole proprietorships – with a maximum eligible investment cost of €200,000, and only under the schemes:

-

“Agri-food – Primary Production and Processing of Agricultural Products – Fisheries and Aquaculture”

-

“Social Entrepreneurship and Handicrafts”

-

AID SCHEMES

Modern Technologies

Eligible investment projects concern the technological upgrading of existing units, research, development and implementation of ideas and technologies that improve goods and services and increase production efficiency, the introduction of new technologically advanced functions and processes, and the integration of production methods with modern information and communication technologies.

Green Transition – Environmental Upgrading of Enterprises

This scheme αφορά investment projects aimed at environmental protection, as well as other existing business activities, provided that expenditures are implemented for energy efficiency measures and environmental protection.

Social Entrepreneurship and Handicrafts

This scheme includes investment projects falling within economic sectors eligible for aid compatible with the internal market, in accordance with Articles 107 and 108 of the Treaty on the Functioning of the European Union, aimed at supporting enterprises developed by vulnerable social groups such as persons with disabilities and long-term unemployed individuals. The types of investments and applicable terms are described in detail in the respective call for proposals.

Special Aid Areas Scheme

This scheme includes investment projects implemented in:

-

Border regional units located along the northern borders of the country

-

Areas with per capita GDP below 70% of the national annual average or experiencing population decline

-

Lignite phase-out zones

-

Areas affected by natural disasters

Indicatively, eligible investment projects include:

-

Productive investments by large enterprises and SMEs, including micro and start-up enterprises, leading to economic diversification, modernization and growth

-

Investments in the establishment of new enterprises resulting in job creation

-

Investments supporting the circular economy, including waste prevention and reduction, efficient use of resources, reuse, repair and recycling

Agri-food – Primary Production and Processing of Agricultural Products – Fisheries – Aquaculture

Provides aid for investment projects in primary agricultural production, processing of agricultural products, and fisheries and aquaculture.

Manufacturing – Supply Chain

Includes investment projects in the manufacturing sector (excluding agricultural product processing) and the development of logistics facilities.

Business Extroversion

Concerns investment projects aimed at enhancing business extroversion and export activities.

Support for Tourism Investments

Provides aid for the establishment, expansion and comprehensive modernization of tourist accommodation and campsites (camping) throughout Greece, aiming to upgrade the quality of the tourism product.

Alternative Forms of Tourism

Eligible investment projects concern alternative forms of tourism and aim to utilize and highlight the distinctive characteristics of Greek regions, such as geographical, social, cultural and religious features.

Large-Scale Investments

Concerns support for investment projects with a budget exceeding €15,000,000, excluding those falling under the aid schemes of:

a) Agri-food – primary production and processing – fisheries

b) Tourism investments

c) Alternative forms of tourism

European Value Chains

Concerns support for investment projects in the fields of European strategic value chains, such as microelectronics, high-performance computing, batteries, connected and autonomous vehicles, cybersecurity, personalized medicine and health, low-carbon industries, hydrogen, and the Internet of Things (IoT).

Entrepreneurship 360°

The purpose of this scheme is to support all investment projects covered by the Development Law (excluding specific categories governed by special schemes), concerning the implementation of initial investments and additional expenditures for the benefit of entrepreneurial initiatives and the national economy.

SCOPE OF INVESTMENT PROJECTS

-

Establishment of a new production unit

-

Expansion of the capacity of an existing unit

-

Diversification of production into products or services not previously produced

-

Fundamental change of the overall production process

ELIGIBLE CATEGORIES OF INVESTMENT PROJECTS

Under Law 4887/2022, investment projects in all sectors of the economy are eligible.

Indicative eligible activities include:

-

Manufacturing investments (establishment, modernization or expansion of industrial units)

-

Tourism investments (establishment or expansion of hotels of at least 4*, modernization of main and non-main tourist accommodation upgraded to at least 3*, guesthouses under conditions, projects in traditional settlements, 5-key accommodation with minimum 20 rooms, 3* camping sites, glamping, condo hotels, youth hostels, alternative tourism, diving tourism, conference centers, golf courses, marinas, ski resorts, theme parks, thermal tourism, thalassotherapy centers, wellness/spa centers, KEPAT, shelters, racetracks, etc.)

-

Agri-food sector investments (primary production and processing)

-

Sports and recreational activities (swimming pools, football, basketball, tennis facilities, etc.)

-

Storage and transport-support activities (marinas, water aerodromes, third-party logistics services, parking facilities)

-

Libraries and museums

-

Information and communication sector: establishment of permanent studio facilities for film, video, television and audio production

-

Real estate management: exceptionally, projects for development and management of O.Y.M.E.D., provided management is exercised over a single O.Y.M.E.D.

-

Other sectors (rehabilitation centers, supported living facilities for persons with disabilities, nursing homes, wholesale trade of oil and LPG on islands for storage facilities, pharmaceutical wholesale trade, industrial laundries, ironing services, etc.)

TYPES OF AID

Eligible investment projects may receive:

-

Tax exemption

-

Direct grant

-

Leasing subsidy

-

Employment cost subsidy

-

Risk finance (applicable to the schemes “Modern Technologies” and “Social Entrepreneurship and Handicrafts”)

A fast-track licensing incentive is also provided for large investments and special aid areas. In addition, loan support schemes with guarantees or co-financing by the Hellenic Development Bank are foreseen for SME investment projects approved under the Large Investments scheme.

MINIMUM INVESTMENT BUDGET

The minimum eligible investment amount is defined by enterprise size as follows:

-

Large enterprises: €1,000,000

-

Medium enterprises and cooperatives: €500,000

-

Small enterprises: €250,000

-

Social Cooperative Enterprises, agricultural and urban cooperatives, producer groups and organizations, agricultural partnerships and micro enterprises: €50,000

ELIGIBLE EXPENDITURES

a. Tangible assets

-

Construction, expansion and modernization of buildings and auxiliary facilities

-

Acquisition of existing fixed assets (buildings, machinery, equipment)

-

Purchase and installation of new modern machinery and equipment, including technical installations and internal transport means

-

Leasing costs for new machinery and equipment, provided ownership is transferred to the lessee at contract expiry

-

Modernization of special and mechanical installations

b. Intangible assets

-

Technology transfer through acquisition of intellectual property rights, licenses, patents, know-how and non-patented technical knowledge

-

Quality assurance systems, certifications, software and business organization systems

c. Expenditures outside Regional Aid

-

Consultancy fees for SMEs (up to €50,000 or 5% of eligible cost)

-

Start-up costs for new and under-establishment small and micro enterprises (up to 20% and €200,000; doubled for innovative enterprises)

-

Research and development costs

-

Innovation costs for SMEs

-

Process and organizational innovation

-

Environmental protection measures

-

Energy efficiency investments

-

High-efficiency cogeneration from RES

-

Renewable energy production

-

District heating/cooling systems

-

Remediation of contaminated sites

-

Recycling and waste reuse

-

Vocational training

-

SME participation in trade fairs

-

Aid for disadvantaged workers

FINANCING OF THE INVESTMENT PROJECT

The beneficiary’s participation may be covered by own funds or external financing, provided that at least 25% of the eligible cost contains no state aid, public support or subsidy.

SUBMISSION OF INVESTMENT PROJECTS

All application and approval procedures are conducted digitally.

Applications and supporting documents are submitted exclusively through the Development Laws Information System (PS-An).

- https://www.anaptyxiakos.gr

- https://www.ependyseis.gr

- http://www.ypoian.gr

- http://www.investingreece.gov.gr